100 Va Disability California Property Taxes

property taxesOne for veterans and one for disabled veterans. To qualify veterans must suffer from conditions that include but may not be limited to blindness in both eyes loss of two or more limbs or a VA-rated total disability condition.

The Benefits To Having An Agent Va Homebuyers Home Buying Home Buying Tips New Homeowner

Disabled Veterans Property Tax Exemption.

100 va disability california property taxes. There is also a property tax exemption for qualifying disabled veterans andor qualifying spouses. The California Constitution and Revenue and Taxation Code Section 2055 provides a property tax exemption for the home of a disabled veteran or an unmarried spouse of a deceased disabled veteran. A disabled veteran in New Hampshire may receive a full property tax exemption on hisher.

Who is eligible for the Disabled Veterans Exemption. California gives a property tax exemption for the home of a disabled veteran or an unmarried spouse of a deceased disabled veteran. The 100 disabled Veterans property tax exemption offers more advantageous terms than both the Veterans and Homeowners Exemptions explained below.

California has two separate property tax exemptions. The Disabled Veterans Exemption reduces the property tax liability on the principal place of residence of qualified veterans who due to a service-connected injury or disease have been rated 100 disabled or are being compensated at the 100 rate due to unemployability. You may attach a copy of your award letter a VA tax letter or another document from the United States Department of Veterans Affairs showing 100 disability compensation due to a service-connected disability and a rating of 100 disability or of individual unemployability.

If you are a qualified itinerant veteran vendor you are the consumer of items owned and sold except alcoholic beverages or items sold for more than 100 and you are not required to hold a sellers permit. Disabled veterans in California may qualify for either basic or low-income property tax exemptions. Are surviving spouses eligible for the.

There is a basic 100000 exemption or a low-income less than 52470 150000 exemption available to a disabled veteran who because of an injury incurred in military service. The exemption amount is adjusted annually due to inflation. 100 percent disabled veterans should also look into other state-offered benefits such as those associated with property taxes and vehicle registration.

If you are a qualified disabled veteran you may claim the basic Disabled Veterans Exemption from property tax on your principal place of residence up to 100000 on the full value of your property or a low-income exemption up to 150000. You must attach documentation as well. The property tax break is known as the California Disabled Veterans Exemption and is intended for those who are VA rated at 100 or are being compensated at the 100 rate due to unemployability An unmarried surviving spouse of a qualified veteran may also qualify.

They must be rated 100 disabled by the Department of Veterans Affairs due to a service-related. Veterans of the United States military who are rated 100 disabled as a result of a service-connected disability or who are compensated at 100 due to unemployability. Veterans who are rated at 100 disability by the VA due to a service-connected disability are eligible for this California disabled Veterans property tax exemption.

Veterans with 100 percent disability ratings may request a property tax waiver although each state may have different qualification requirements. This benefit include a basic 100000 exemption plus a low-income version.

Mississippi Property Tax Calculator Smartasset

Property Tax Calculation For San Diego Real Estate Tips For Homeowners

Cook County Makes Millions By Selling Property Tax Debt But At What Cost Npr

Disabled Veterans Property Tax Exemptions By State Military Benefits

Do My Property Taxes Increase If I Put A Cheap Mobile Home Or Rv On My Houston Texas Land Quora

5 States With No Property Tax In 2018 Mashvisor

Https Www Titleadvantage Com Mdocs Homeowners 20prop 20tax 20exemption 20all Pdf

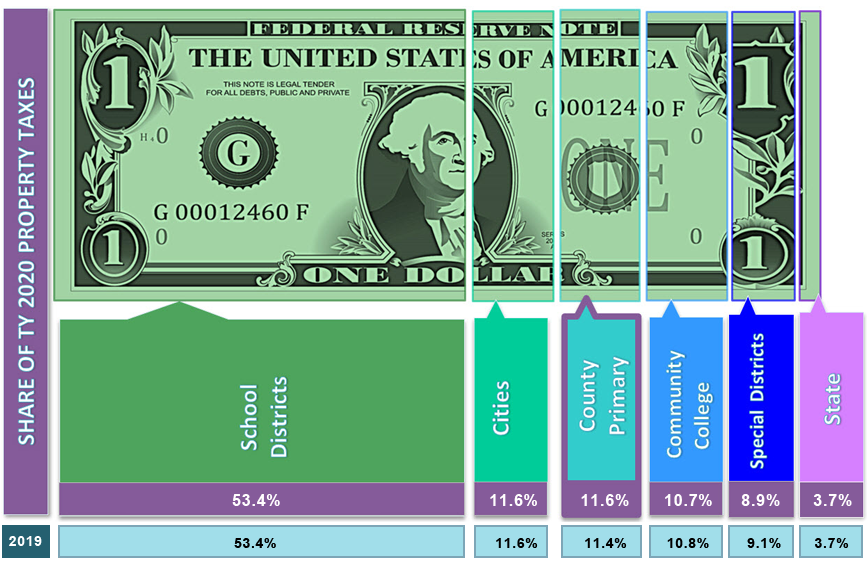

Washington Property Taxes How The New Tax Law Affects You

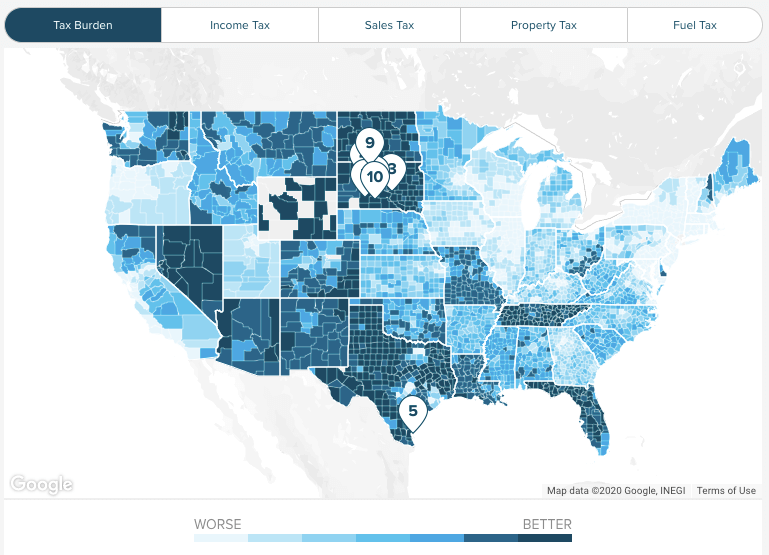

Colorado Retirement Tax Friendliness Smartasset

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Kentucky Income Tax Calculator Smartasset

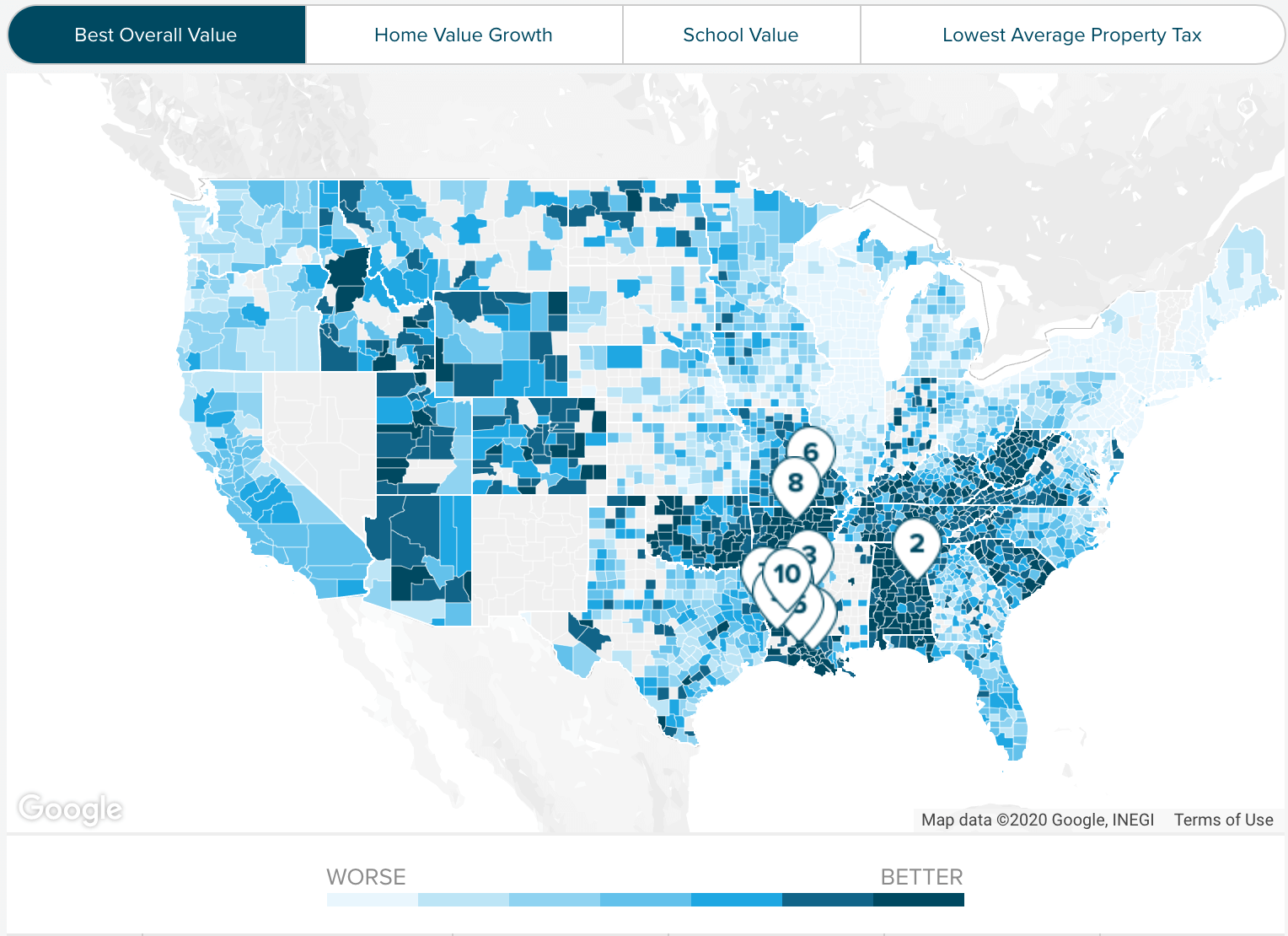

Thinking About Moving These States Have The Lowest Property Taxes

What Is The Disability Property Tax Exemption Millionacres

Are You A Veteran In Needs To Help With Disability Claim Veteran Veterans Benefits Estate Planning

Are There Any States With No Property Tax In 2021 Free Investor Guide

/getty-moneyhouse_1500_157590565-56a7269c5f9b58b7d0e757e3.jpg)

Taking Advantage Of Property Tax Abatement Programs