Do 100 Percent Disabled Veterans Pay Property Taxes In Tennessee

disabled veterans wallpaperA yes vote on Amendment 2 would allow disabled veterans of the United States armed forces or Virginia National Guard who are 100 percent permanently and totally disabled to receive a tax break on one car or pickup truck they own. The qualifying conditions for this property tax exemption include but may not be limited to one or more of the following.

Are There Any States With No Property Tax In 2021 Free Investor Guide

Tennessee State Veteran Benefits The Tennessee Department of Veterans Services TDVS operates 10 State Veterans Services Offices five Tennessee State Veterans Cemeteries serves as liaison for four Tennessee State Veterans Homes assists with active duty casualties and hosts outreach events across the state to raise awareness and assist Veterans as well as their families.

Do 100 percent disabled veterans pay property taxes in tennessee. A veteran can be rated 100 Total without being Permanent. Disabled Veterans Property Tax Relief Property tax relief for certain 100 disabled. 100 service-connected disabled Veterans may be fully exempt from property taxes.

The maximum market value on which tax relief is calculated is 175000. This usually happens when VA assumes a disability may improve. The bill also increases the amount of the regular disabled veterans exemption for veterans who have a disability rating of 30 50 or 70.

See all South Dakota Veterans Benefits. Disabled veterans paying taxes in the State of Tennessee may qualify for a state property tax exemption on the first 100000 of hisher primary residence if the veteran is VA-rated 100 disabled or meets the following criteria. A service-connected permanent and total disability or disabilities as determined by the United States Department of Veterans Affairs.

I had to file 2 amended tax returns this year because Turbo Tax did not recognize this lawcost me 950 to have a tax professional to refile my returns. Department of Veterans Affairs due to a 100 percent disability rating or determination of individual unemployability by the US. Qualified surviving spouses of disabled Veterans may also qualify for benefits.

Individual Income Tax Return to correct a previously filed Form 1040 1040A or 1040EZ. A 100 total and permanent disability rating from being a prisoner of war. Temporary 100 percent disability.

Disabled veterans also have a. Disabled veterans with qualifying VA-rated conditions and certain surviving spouses may be eligible for a property tax break up to 100000 for primary residences only. Department of Veterans Affairs.

You can tell if a 100 award is Permanent and Total PT as the decision will approve Dependents Educational Assistance and Chapter 35 Benefits. The combat-disabled veteran applying for and being granted Combat-Related Special Compensation after an award for Concurrent Retirement and Disability. Tennessee State Property Tax Relief For Qualified Disabled Veterans.

The exemption amount varies by county. The 525 Law allows 100 VA Disabled veterans from having to pay federal income taxes on Military Retirement Pay and the VA Pension. Veterans with 100 percent disability ratings may request a property tax waiver although each state may have different qualification requirements.

In certain cases veterans who are not rated at 100 percent but are unable to work as a result of their service-connected disability may be paid at the 100 percent rate if they can prove to the VA how impaired they are. Tennessee Property Tax Exemptions. Any former POW or 100 permanent and total disabled veteran is exempt from the county motor vehicle priviege tax.

A disabled veteran in Tennessee may receive a property tax exemption on the first 175000 of hisher primary residence if the veteran is 100 percent disabled and has lost the use of two or more limbs or is blind in both eyes as a result of service. There are several property tax exemption programs available for Veterans in Texas. A service-connected disability that resulted in.

Homeowners who are 100 disabled qualify for a property tax credit in Missouri the sum of which is based on the taxes paid and the residents household income. This bill provides for a 100 exemption for the residence homestead of qualified disabled veterans. Tennessee County Motor Vehicle Privilege Tax Disabled Veteran Exemption.

To do so the disabled veteran will need to file the amended return Form 1040X Amended US. 100 percent disabled veterans should also look into other state-offered benefits such as those associated with property taxes and vehicle registration. Any disabled Veteran who has a 100 percent permanent total disability from a service connected cause or any former.

A disabled veteran in Tennessee may receive a property tax exemption of up to the first 100000 of hisher primary residence if the veteran is 100 percent disabled hisher income does not exceed 60000 has lost the use of two or more limbs or is blind in both eyes as a result of service. Must own and use property as primary residence. 1 VA Co-Pay Reimbursement.

10 90 disabled allows for discounts of tax value ranging from 5000 12000. Tax Code Section 11131 requires an exemption of the total appraised value of homesteads of Texas veterans who received 100 percent compensation from the US.

Georgia Veteran S Benefits Military Benefits

90 Percent Va Disability Appeal Or Increase From 90 To 100 Rating

Do Military Veterans Get Property Tax Breaks In The U S Mansion Global

Va Loan Closing Costs 2021 What Does The Veteran Pay

:max_bytes(150000):strip_icc()/treasury_building_478635991-5bfc345146e0fb00265d8f91.jpg)

The 10 Best States For Property Taxes And Why

States That Offer Free Tuition For Vets Military Benefits

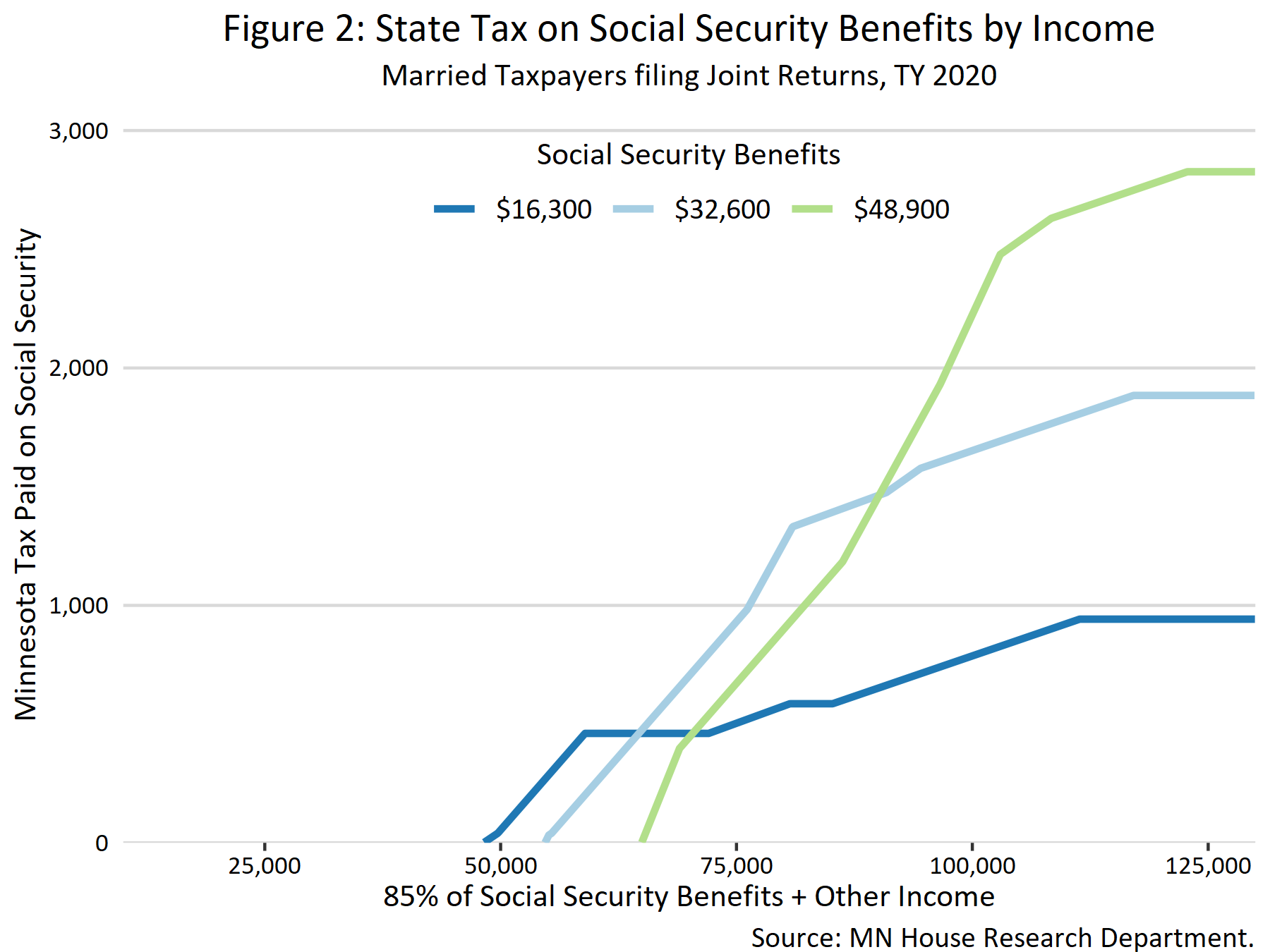

Taxation Of Social Security Benefits Mn House Research

License Fees Tennessee Fishing Guide 2020 Eregulations

Tennessee Veteran S Benefits Military Benefits

Kentucky Veteran S Benefits Military Benefits

How Does Homestead Exemption Work

What Does It Mean To Be 100 Disabled By The Va Cck Law

Purple Heart Benefits Military Benefits

What Does Homeowner Exemption Mean

Military And Veteran License Plates Department Of Military Veterans Affairs

Benefits For 100 Percent Disabled Veterans Veterans Ptsd Lawyers

Pin On Best Of Chickery S Travels