Va Insurance And Hsa

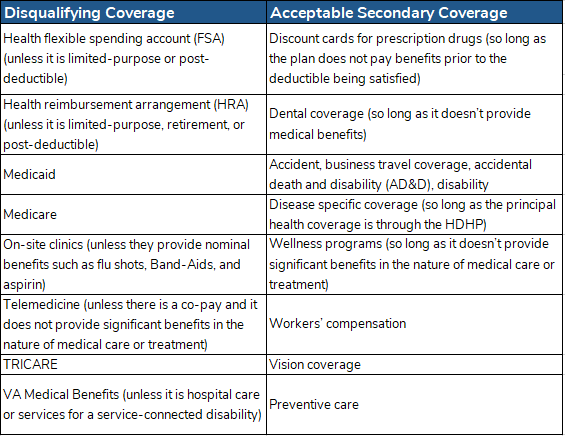

insurance wallpaperAn individual who is an otherwise HSA eligible individual receiving Department of Veterans Affairs VA medical benefits other than disregarded coverage eg vision or dental or preventive care is ineligible to make an HSA regular contribution for the month of and the two months following the month he or she received medical benefits through the VA. In order to contribute to health savings account HSA you must be enrolled in a high deductible health plan HDHP and you cant be enrolled in any of these other health plans.

Hsa Vs Fsa Differences And How To Choose Nerdwallet Cheap Health Insurance Health Insurance Affordable Health Insurance

Before the new law getting VA benefits even for service-related disabilities created a conflict.

Va insurance and hsa. Generally the rule has always been that a veteran who is eligible for VA benefits but has not actually received VA benefits in the preceding three months can still be eligible to make or receive HSA contributions. An individual actually receiving medical benefits from the VA is not disallowed from making HSA contributions if the medical benefits consist solely of 1 disregarded coverage 2 preventive care or 3 hospital care or medical services under any law administered by the Secretary of Veterans Affairs for service-connected disability within the meaning of 101 16 of title 38 United States Code. There is other coverage that can but does not always prevent HSA eligibility such as VA medical benefits.

Health Savings Account An HSA is offered by employers in conjunction with a high deductible health insurance policy. First the IRS provides that the statutory exemption for insurance for one or more specified diseases or illnesses means just what it says. That said understanding how VA medical benefits could impact an otherwise HSA-eligible individuals ability to contribute to his or her HSA is important.

Veterans with high deductible health plans HDHP are also likely to have health savings accounts HSAs which allow tax-free funds to be used to pay medical costs. Self-employed people who have high deductible plans also can set up HSA accounts. Veterans with private health insurance now often have health insurance plans that require them to meet a high deductible before benefits are covered other than preven- tive services.

Actually if you use the va your not allowed to contribute to a hsa in order to contribute you must not have been to the v in the last three months. VA can bill your insurance company directly or can be reimbursed using a linked Health Reimbursement Account HRA. Receiving preventive care services or treatment for a service-related disability from the VA does not disqualify an individual from participating in an HSA.

VA Benefits can be used for the following expenses without affecting what you can deposit into your HSA. The problem comes if you do a traditional plan and your spouse is on a HSA you cant have a flex spending account As it is illegal. Get answers to questions about how VA health care works for Veterans with other insurance.

HSAs and Accessing VA and IHS Care. In this paper we travel to the intersection of HSAs and the Department of Veterans Affairs VA and Indian Health Services IHS to see how these programs affect individuals HSA eligibility. The IRSs own interpretations of the HSA statute support and compel the conclusion that VA care for service-connected disabilities is indeed permitted insurance and therefore disregarded coverage.

Veterans who received medical benefits from the VA at any time during the previous three months ARE NOT HSA eligible. The rules around Health Savings Account HSA eligibility are simple on the surface but decidedly more complex when they involve certain federal government medical programs. An employer-sponsored health policy that is not an HDHP Medicare A health FSA whether yours or your spouses TRICA.

As a Veteran you are eligible to open and fund a Health Savings Account HSA. HSA is only available to you if you have a high deductible health plan HDHP and can be offered to you through many entities including banks credit unions employers insurance companies and more. Both you and your employer can make HSA contributions if youre otherwise eligible regardless of when you receive treatment.

There are significant benefits of having private health insurance. Previously the law stated that aside from preventive care veterans receiving VA services were ineligible to contribute to an HSA for the 3 months following the date of service. May reduce or eliminate your copayments.

Find out how you can use VA health care along with other health insurance like a private insurance plan Medicare Medicaid or TRICARE. VA hospitals do not accept high deductible health plans because they dont meet the deductible requirements. HSA- Health Savings Account.

Specific coverage for a condition such as cancer or diabetes. Because benefits received through the Department of Veteran Affairs VA is not an HDHP VA coverage can create eligibility concerns for otherwise HSA-eligible individuals. However use of your VA Benefits can have an effect on what you are allowed to deposit into your HSA each year.

We offer affordable health insurance for individuals families and employers HSA Insurance - Affordable Health Insurance To use the full functionality of this site it is necessary to enable JavaScript. HDHPs are usually linked to a Health Savings Account HSA which can be used to pay VA copayments. Whenever you used VA benefits you had to wait three months before you could make another HSA contribution.

You may be thinking that you dont have Tricare so you should be able to use your HSA to pay for VA hospital costs. Also high deductible health plans usually are linked to HSAs. IRS guidance now includes.

The money does roll over at the end of the year.

Hsa Contribution Limits For 2020 And More Hsa Rules You D Better Know Investor S Business Daily Health Savings Account Hsa Investors Business Daily

Learn About The Eligibility Guidelines And Annual Contribution Limits For A Tax Favored Hs Health Savings Account High Deductible Health Plan Finance Investing

Turning 65 Follow Your Path To Medicare Medicare Advantage Medicare Medicare Supplement

14 Actual Va Raters Reveal 3 Secret Va Claim Tips Youtube Personal Statement Veterans Benefits Va Disability

So What Exactly Is An Hsa Health Savings Account Health Savings Account Accounting Health

3 Healthy Habits For Health Savings Accounts Fidelity Health Savings Account Savings Account Habits

Hsas For Veterans Abd Insurance Financial Services

Health Savings Accounts Hsas The Most Badass Early Retirement Savings Vehicle Health Savings Account Early Retirement Saving For Retirement

Understanding Priority Health Insurance During Open Enrollment Health Insurance Health Insurance Options Free Health Insurance

What You Need To Know About Hsas Hras And Fsas

What S Cobra In 2020 Health Savings Account Long Term Care Insurance Tax Guide

Health Savings Accounts What You Need To Know Bim Group

Confused About The Fsa Vs Hsa Let S Examine The Health Savings Account Vs Flexible Spending Account Th Health Savings Account Life Insurance Humor Accounting

Health Savings Account Hsa Obamacare Facts Health Savings Account Savings Account Saving Money