West Virginia Unemployment Rate History

history rate unemployment wallpaperYou can also see West Virginia unemployment compared to other states. West Virginias unemployment rate dropped more than two percentage points in October leading to the states 64 rate.

This Map Shows The Unemployment Rate In Each Of The Arc Counties Appalachian Unemployment Rates Range From 3 4 T Appalachia Appalachian Appalachian Mountains

West Virginia Unemployment Rate 630 for Dec 2020.

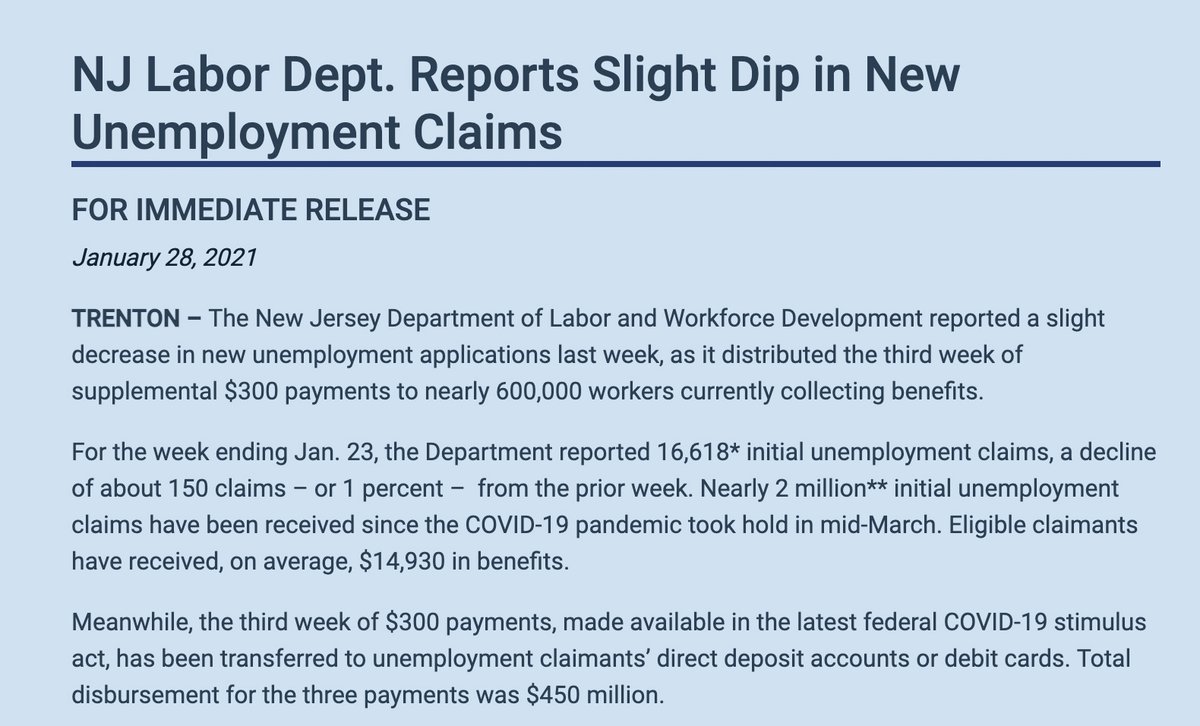

West virginia unemployment rate history. Graph and download economic data for Unemployment Rate in Tucker County WV WVTUCK3URN from Jan 1990 to Nov 2020 about Tucker County WV. Bureau of Labor Statistics Note. AP West Virginias seasonally adjusted unemployment rate dipped one-tenth of a percentage point to 47 in June.

Bureau of Labor Statistics BLS for the State Employment and Unemployment release. This graph shows the poverty rate in West Virginia from 2000 to 2019. Published by Statista Research Department Jan 20 2021 This statistic displays the unemployment rate in West Virginia from 1992 to 2019.

WorkForce West Virginia - Find resources for finding a job collecting unemployment benefits information about the labor market resources for veterans and news about employment conditions in West Virginia. Charleston West Virginia Unemployment Rate The chart depicted above shows the statistic history. Graph and download economic data for Unemployment Rate in West Virginia WVUR from Jan 1976 to Dec 2020 about WV unemployment rate and USA.

From a post peak low of 63 in November 2020 the unemployment rate has now grown by 00 percentage points. WorkForce West Virginia says its the lowest rate for the state since October 2008. Since 2005 the unemployment rate in West Virginia has ranged from 36 in September 2008 to 158 in April 2020.

The unemployment rate in Wheeling peaked in April 2020 at 177 and is now 69 percentage points lower. 64 Rounding out our list and coming in at 10 is the city of Bridgeport West Virginia. Unemployment insurance benefits provide temporary financial assistance to workers unemployed through no fault of their own that meet West Virginias eligibility requirements.

For the same month the metro unemployment rate was 09 percentage points higher than the West Virginia rate. This page provides forecast and historical data charts statistics news and updates for West Virginia Unemployment Rate. See how other local areas compare by using our Unemployment Compare tool.

Its increases and decreases beginning 15 years ago spanning until present day WV Unemployment Rate in Huntington This picture shown compares figures of the recent years of 2010 to 2011 and 2011 to 2012. Unemployment Rate for West Virginia from US. In depth view into West Virginia Unemployment Rate including historical data from 1976 charts and stats.

The current unemployment rate for Wetzel County is 70 in October 2020. Dont forget just because its last place in this top ten list thats still out of 27. The current unemployment rate for West Virginia is 57 for November 2020.

Also nicknamed the unemployment rate this number is tabulated every month on a state level and for the national as a whole. January 29 2021 Source. In 2019 the unemployment rate in West Virginia was 49.

West Virginia includes the following metropolitan areas for which an Economy At A Glance table is available. More data series including additional geographic areas are available through the Databases Tables tab at the top of this page. The unemployment rate calculates the number.

The unemployment rate in West Virginia peaked in April 2020 at 159 and is now 96 percentage points lower. Since 2005 the unemployment rate in Wetzel County West Virginia has ranged from 50 in October 2018 to 200 in January 1993. The BLS reported that the unemployment rate for Wheeling fell 11 percentage points in July 2020 to 108.

Before the pandemic hit we were churning out the best unemployment rates and total job numbers that West Virginia had seen in over a decade. In 2019 16 percent of West Virginias population lived below the poverty line. Theres no doubt that the pandemic was like a cannonball to the stomach.

In order to qualify for this benefit program you must have West Virginia wages during the past 12 to 18 months and have earned at least a minimum amount of wages as determined by West Virginias guidelines. The number of unemployed state residents fell by 500 last month to 37300. West Virginia Unemployment Rates Information The jobless rate has been a way for accurately measuring the strength and overall health of the economy for over 35 years.

See how other local areas compare by using our Unemployment Compare tool.