Do You Lose Your Widow's Pension When You Remarry

pension widows yourYou will not get it if you remarry or form a new civil. However if someone is married at pension.

Widows Pension For Life Legal Claim Narpo Gloucester

Widows Pension For Life Legal Claim Narpo Gloucester

But if she remarries before age 60 she loses her widows benefits.

Do you lose your widow's pension when you remarry. However if your are a widow widower or surviving divorced spouse who remarries after age 60 you are entitled to benefits on your prior deceased spouses Social Security earnings record. Regarding Death Survivors Pension benefits the law generally requires a surviving spouses entitlement to be terminated if the surviving spouse remarries regardless of age even if that remarriage is. Once youve filled in form BB1 return it to your local Jobcentre Plus.

If you receive benefits as a widow divorced widow widower or divorced widower You cannot get benefits if you remarry before age 60 or if you are disabled and remarry before age 50. Also remarriage of a surviving spouse after the age of 57 does not preclude continued payment of DIC. Widowers only receive a surviving spouses pension if they have children under the age of 18 who need to be cared for.

Claims are dated from when the office receives them and can only be backdated by up to three months so if you delay you might lose some benefit. Updated October 23 2020. If you were widowed twice you may be entitled to survivor benefits based on the work records of both late spouses but you can only collect one such payment at a time.

When you die some of your State Pension entitlements may pass to your widow widower or surviving civil partner. If you marry register a civil partnership or live with someone as a couple any means-tested benefits you receive such as Universal Credit Pension Credit Housing Benefit Rate Relief in Northern Ireland or Council Tax Support may be affected. But as Linda Lamb explains there are some pension schemes which will still pay out.

Once that calculation has been done getting married or getting divorced after. Youll get any State Pension based on your husband wife or civil partners National Insurance contribution when you claim your own pension. Hi Lynn Remarriages occurring after a widow reaches 60 or age 50 if the widow is disabled and eligible for disabled widows benefits do not affect the widows eligibility for widows benefits on.

The law has been pretty harsh on surviving spouses who wish to retain a widows pension upon remarriage. If a woman decides to remarry her entitlement to a widows pension lapses at the end of the month following the new marriage. You may inherit a part of your.

You will not be able to inherit your partners Pension if you remarry or form a new civil partnership before you reach State Pension age which you can check here. If you remarry you generally cannot collect benefits on your former spouses record unless your later marriage ends whether by death divorce or annulment. Marrying after state pension age cannot take away your entitlement to a pension you were entitled to draw at pension age by dint of an earlier marriage.

It would be rare for any scheme to now have a rule removing the widows pension on remarriage but it is not the rules which apply to someone becoming widowed now that will apply to you. Remarriage Brings Many Changes. It ceases on remarriage or on the formation of a new civil partnership or cohabitation.

The Social Security Administration can supply information on which record would provide the larger benefit. A pension for a widow widower or surviving civil partner normally of half of the officers pension entitlement. If she has kids from the marriage and they are under 16 she can receive survivors benefits before age 60.

If you die while they are under state pension age they will lose this right if they remarry or enter into a new civil partnership before they reach state pension age. If you die while they are under state pension age they will lose this right if they remarry or enter into a new civil partnership before they reach state pension age. If you remarry or start living with someone you will no longer qualify for bereavement allowance.

If you remarry before you turn 50 you will not be entitled to survivors benefits unless the marriage ends. Even if you are divorced if the marriage lasted ten years the widow is eligible to receive benefits after she turns 60. Under the new state pension things are much simpler and it is mainly your own contribution record that matters.

Notify the office that pays your benefits as soon as possible. When you die some of your State Pension entitlements may pass to your widow widower or surviving civil partner. Therefore after September 30 1998 eligibility for DIC is established in any case in which the remarriage of the surviving spouse is terminated by death divorce or annulment.

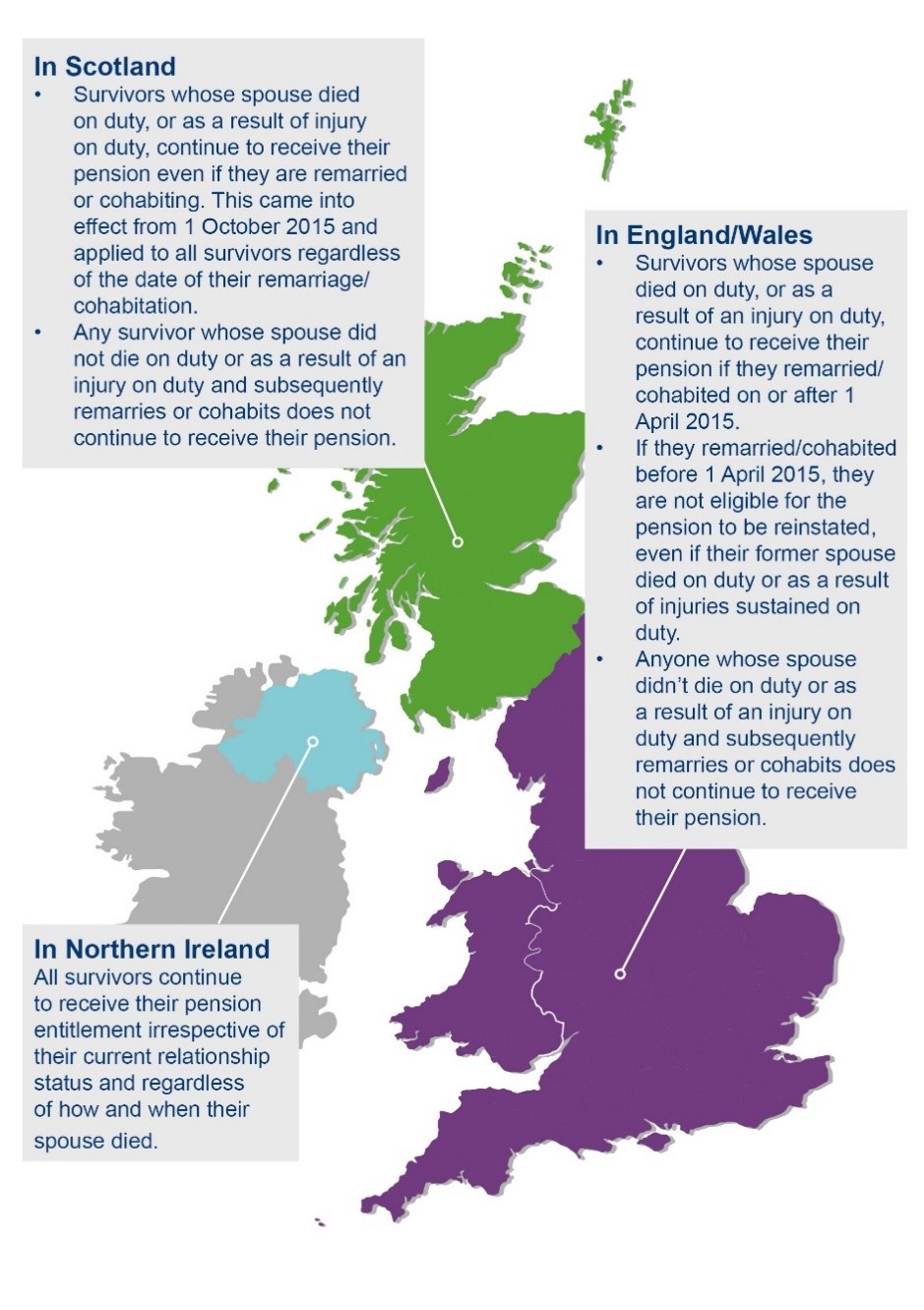

One group of survivors that has not been helped by the Regulations are cohabitants. Recently much-needed awareness has been raised on the complicated laws around access to late spouses pensions upon remarriage.

What Happens To My Ex Husband S Qdro Pension If I Remarry

What Happens To My Ex Husband S Qdro Pension If I Remarry

Is A Widow Entitled To A Deceased Husband S Pension Benefits

Is A Widow Entitled To A Deceased Husband S Pension Benefits

Rights Of Surviving Spouses Wiser Women

Rights Of Surviving Spouses Wiser Women

Https Www Met Police Uk Syssiteassets Foi Media Metropolitan Police Disclosure 2019 November 2019 Information Rights Unit Loss Of Widow S Pension

Do You Lose Your Nhs Pension Benefits When You Die Legal Medical Investments Financial Advisers

Do You Lose Your Nhs Pension Benefits When You Die Legal Medical Investments Financial Advisers

Http Researchbriefings Files Parliament Uk Documents Sn01424 Sn01424 Pdf

Civil Service Pensions Classic Scheme Guide

Civil Service Pensions Classic Scheme Guide

Understanding The Cpp Survivor S Pension Retire Happy

Understanding The Cpp Survivor S Pension Retire Happy

Widows Of Govt Servants Eligible For Family Pension After Remarriage Cat India News

Widows Of Govt Servants Eligible For Family Pension After Remarriage Cat India News

Veterans Benefits For Widows Explained Hill Ponton P A

Veterans Benefits For Widows Explained Hill Ponton P A

Guide To Social Security Death Benefits Simplywise

Guide To Social Security Death Benefits Simplywise

![]() Nhs Widows Pension Can You Keep It If You Remarry Moneysavingexpert Forum

Nhs Widows Pension Can You Keep It If You Remarry Moneysavingexpert Forum

Will I Lose My Widow S Pension If I Remarry

Will I Lose My Widow S Pension If I Remarry

Widow S Pensions What Happens In The Event Of Remarriage Credit Suisse Switzerland

Widow S Pensions What Happens In The Event Of Remarriage Credit Suisse Switzerland

Spousal Social Security Death Benefits Remarriage

Spousal Social Security Death Benefits Remarriage

Remarrying Cost Me My 24k Widow S Pension Pot

Remarrying Cost Me My 24k Widow S Pension Pot

What Is A Widow S Pension Pensionbee

What Is A Widow S Pension Pensionbee

What Are The Pros And Cons Of Widow Remarriage

What Are The Pros And Cons Of Widow Remarriage

Ex Wife Entitled To Military Pension If Remarries Batson Nolan Plc

Ex Wife Entitled To Military Pension If Remarries Batson Nolan Plc