Va Pension Payments After Death

death payments pensionAll requests to stop veterans benefits must go through the VA which requires verbal and written notification along with paperwork to support the reason for. If your parent received the VA Aid Attendance pension it is important that you notify the VA of their death as soon as possible so that you will not receive payments from the VA that you will be required to return later.

Dic Benefits For Widows Guide Dependency And Indemnity Compensation

Department of Veterans Affairs Claims Intake Center.

Va pension payments after death. However it is in the best interest of the surviving spouse to file for DIC benefits within one year from the veterans date of death. Assuming the veterans circumstances meet one of the three circumstances referenced above a surviving spouse needs to complete VA Form 21-534. If you qualify for Veterans Pension benefits the amount you get will be based on the difference between your countable income and a limit that Congress sets called the Maximum Annual Pension Rate or MAPR.

The veterans family or representative can apply for a veterans burial allowance or veterans death benefit in certain cases. The burial allowance can help pay for burial funeral and transportation costs. There is no deadline for the filing date.

There is mention in the post of a niece but not of a spouse. If the Veteran is buried in a VA national cemetery some or all of the cost of transporting the deceased may be reimbursed. These include veterans receiving a VA pension or compensation.

135756 monthly rate 33632 1st child under age 18 33632 2nd child under age 18 28827 8-year provision 33632 Aid and Attendance 28900 transitional benefit for the first 2 years after the Veterans death 294379 per month. Careers and employment Apply for vocational rehabilitation services get support for your Veteran-owned small business and access other career resources. If the veteran was enrolled in a VA-sponsored life insurance policy call the VA at 1-800-669-8477.

Learn about VA pension rates for Veterans including VA Aid and Attendance rates. Service-related Death VA will pay up to 2000 toward burial expenses for deaths on or after September 11 2001 or up to 1500 for deaths prior to September 11 2001. VA Survivors Pension A VA Survivors Pension offers monthly payments to qualified surviving spouses and unmarried dependent children of wartime Veterans who meet certain income and net worth limits set by Congress.

You can still file a claim and apply for benefits during the coronavirus pandemic. Learn about benefits available to surviving family members Much much more To obtain copy of your loved ones service record DD-214 please contact the National Archives All survivor claims should be submitted to your appropriate Pension Management Center. When a veteran dies VA terminates as of the first day of the month of the veterans death any compensation or pension the veteran may have been receiving.

You can still file a claim and apply for benefits during the coronavirus pandemic. If the veteran was receiving disability compensation or a pension call the Veterans Benefits Administration at 1-800-827-1000. A veteran or a veterans representative typically makes a benefits discontinuation request after a life change such as the veterans death reentrance into the military or incarceration.

Find out if you qualify and how to apply. The consequences of delaying this important step can be unpleasant. Get help planning a burial in a VA national cemetery order a headstone or other memorial item to honor a Veterans service and apply for survivor and dependent benefits.

VA Survivors Pension A VA Survivors Pension offers monthly payments to qualified surviving spouses and unmarried dependent children of wartime Veterans who meet certain income and net worth limits set by Congress. Total monthly payment for the first 2 years. When in doubt contact the VA office.

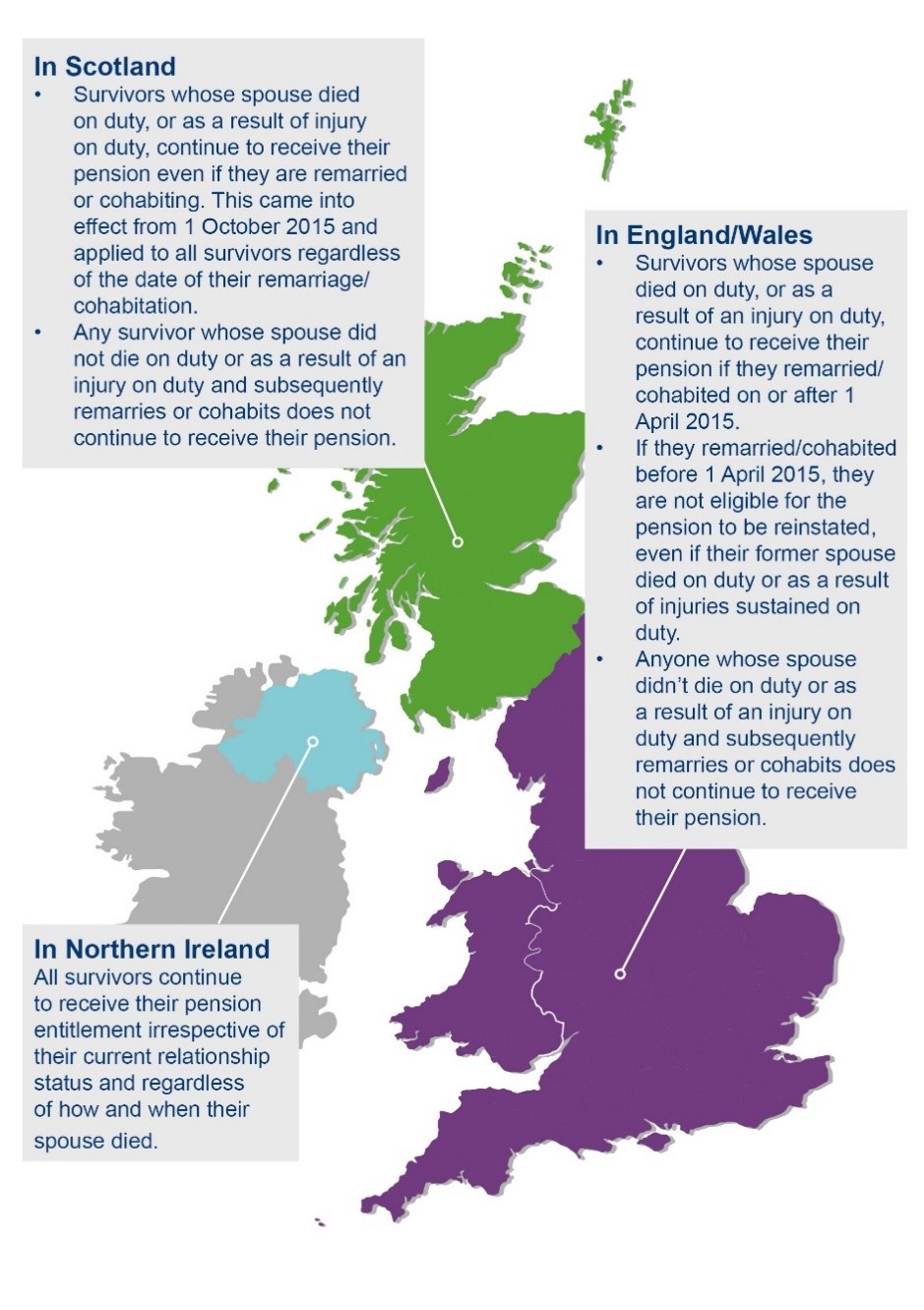

These benefits also continue if the spouse remarried on or after reaching the age of 57. Philadelphia VA Regional Office. Benefits are no longer given to these partners unless the remarriage ended in divorce death or annulment.

Your local office is the only one who looks at your specific situation to determine what options are available. It cant be used for cremation which is a funeral director service. This benefit is only payable to surviving spouses of veterans who were receiving VA compensation.

Find out if you qualify and how to apply.