How To Apply For A Widows Pension

apply widowsYou may also visit your local regional benefit office and turn in your application for processing. Call the International Pension Centre to apply.

Wealthcare 4 Widows Wealthcare Management Coaching For Widows Pension Benefits Widow Coaching

State Pension rules changed in April 2016 and the updated rules changed what you are entitled to in the tragic event your partner dies.

How to apply for a widows pension. The Pension Schemes Act 2015 and the Taxation of Pensions Act 2014 made this rule. The Widows pension awarded to widows over 45-years-old was replaced by the bereavement allowance in 2001. 1 Generally you must Be at least 60 years old Be the widow or widower of a fully insured worker Have been married at least 9 months to the deceased.

These processes apply to England Scotland and Wales but there is a different. All must have been made before the death of the spouse or civil partner. You need to be over State Pension age to claim extra payments from your husband wife or civil partners State Pension.

A partner reached state pension age before April 6 2016. 44 0 191 218 7608 Monday to Friday 930am to 330pm Find out about call charges. DBS Veterans UK Pensions Division Mail Point 480.

As soon as the Canada Pension Plan CPP has all the information and documentation your application will be processed. To qualify for this benefit your partner must have made at least 25 weeks worth of National Insurance contributions or suffered a job-related death. You must claim within 3 months of your partners death to get.

Your income will probably change after the death of your husband wife or civil partner. You can still file a claim and apply for benefits during the coronavirus pandemic. If your partner died on or after 6 April 2017 you could qualify for a different type of benefit called the bereavement support payment.

You also need to be UK-based and under the state pension age. You can apply for a Pension online Image. Download the State Pension claim form and send it to your local pension centre.

You can choose whether to apply for Bereavement Support Payment by filling in a paper form or applying via phone. What you get and how you claim will depend on whether you reached State. Form SSA-10 Information You Need to Apply for Widows Widowers or Surviving Divorced Spouses Benefits You can apply for benefits by calling our national toll-free service at 1-800-772-1213 TTY 1-800-325-0778 or visiting your local Social Security office.

If you get extra money from pensions annuities benefits or an inheritance you may need to pay more tax. To apply you must complete the Canada Pension Plan survivors pension and childrens benefits application form ISP1300 and mail it to us. But one of the following state pension circumstances must apply to a persons situation for this to be the case.

Claim from abroad including the Channel Islands. Application for pension transfers should be made to. If your spouse or civil partner passed away on or after 6 April 2017 you may be able to claim the bereavement support payment if youre under State Pension age.

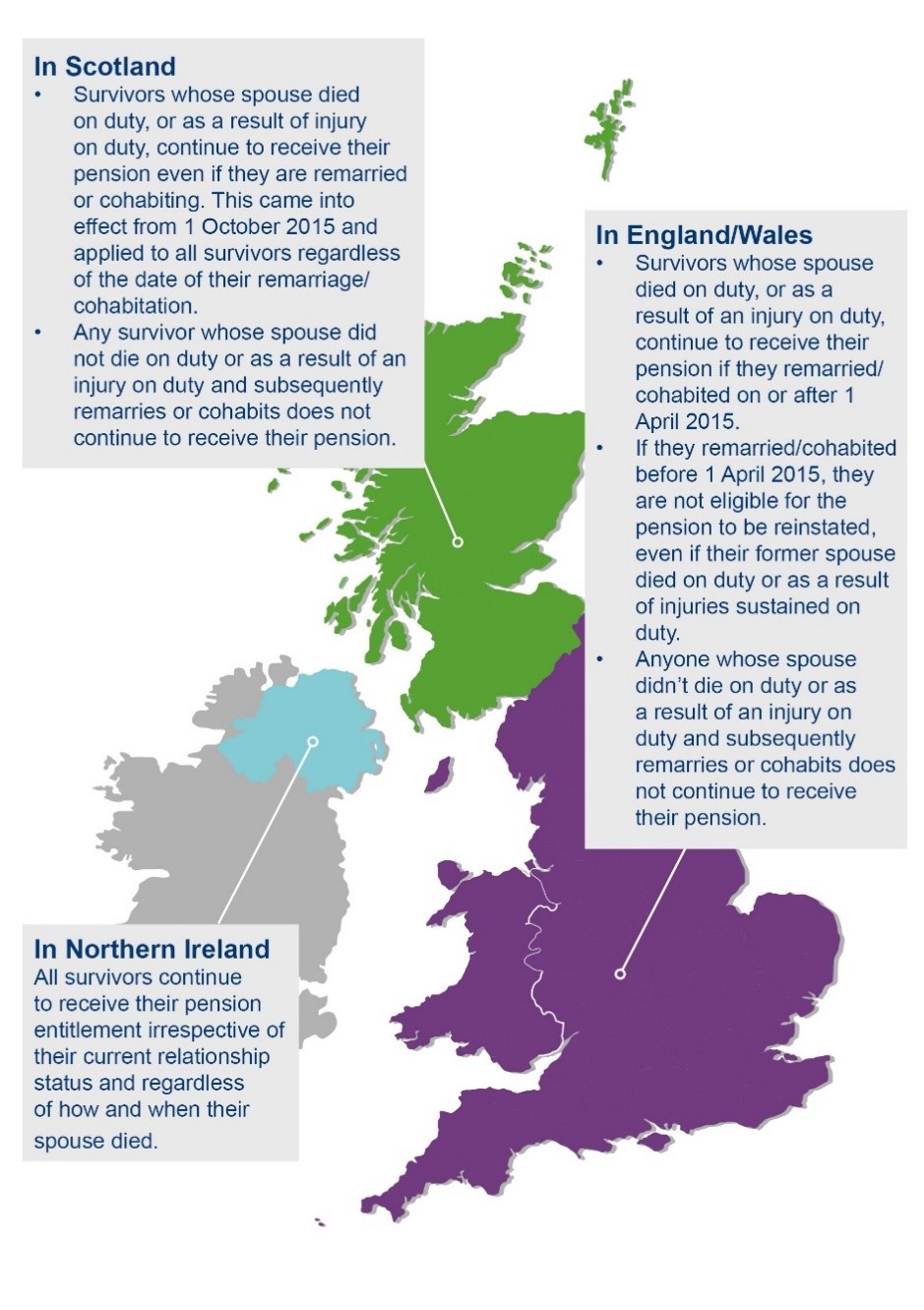

Will I lose my pension if I remarry. Here are some basic guidelines that will let you know if you could qualify. Find out if you qualify and how to apply.

You can get some of your partners entitlement but this. When will my survivors pension start. To apply for Survivors Pension download and complete VA Form 21P-534EZ Application for DIC Death Pension andor Accrued Benefits and mail it to the Pension Management Center PMC that serves your state.

International Pension Centre Telephone. To qualify for a Widows Widowers or Surviving Civil Partners Contributory Pension either you or your late spouse or civil partner must have a certain number of PRSI contributions. To qualify your partner needed to have made at least 25 weeks worth of National Insurance contributions or suffered a job-related death.

The survivors pension starts at the earliest the month after the contributors death. Eligibility You may be able to get Bereavement Support Payment BSP if your husband wife or civil partner died in the last 21 months. A VA Survivors Pension offers monthly payments to qualified surviving spouses and unmarried dependent children of wartime Veterans who meet certain income and net worth limits set by Congress.

All the PRSI requirements must be met on one persons record - you may not combine the contributions of both spouses or civil partners. There are 3 ways to claim the basic State Pension.